Law Of Large Numbers Insurance Risk

The larger the sample size, the lower the relative risk, everything else being equal. The company can only identify the probable number of claims and the claim dollars itll incur from these 100000 renters collectively.

Topic 7 Characteristics Of An Insurable Risk Bus 200 Introduction To Risk Management And Insurance Jin Park - Ppt Download

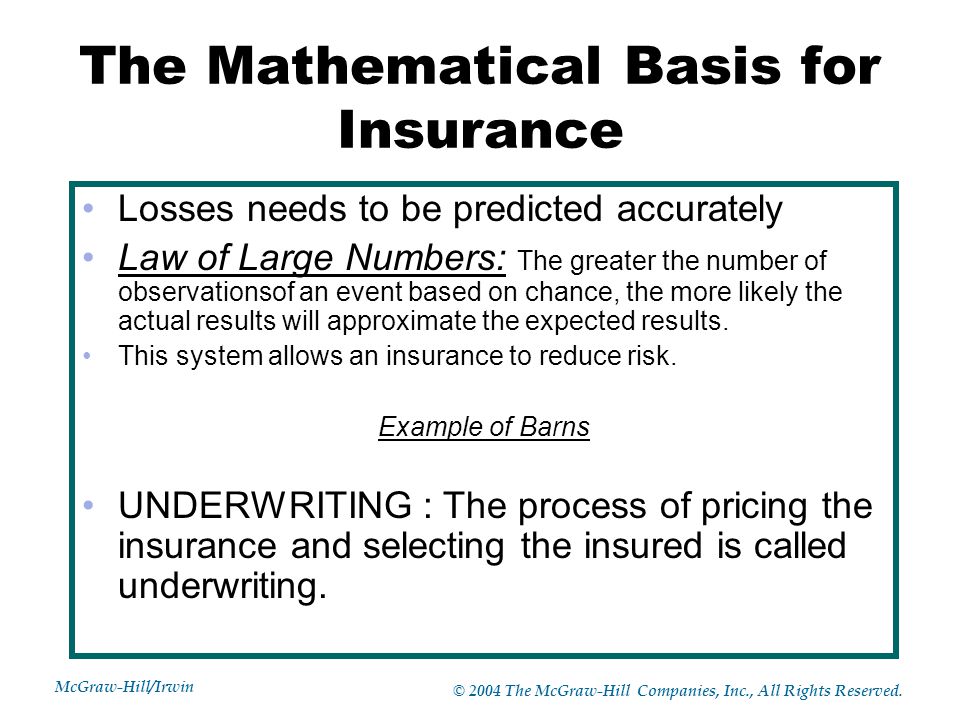

Law of large numbers is the basis for successfully running insurance business.

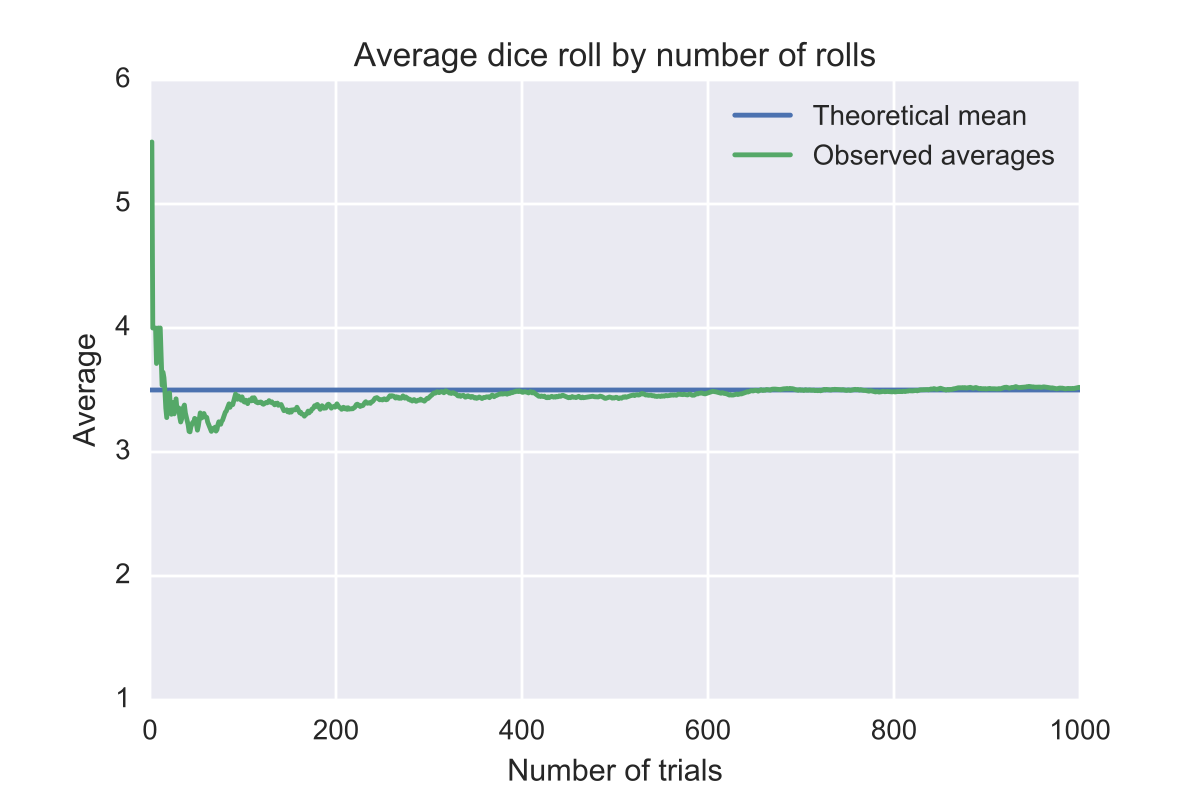

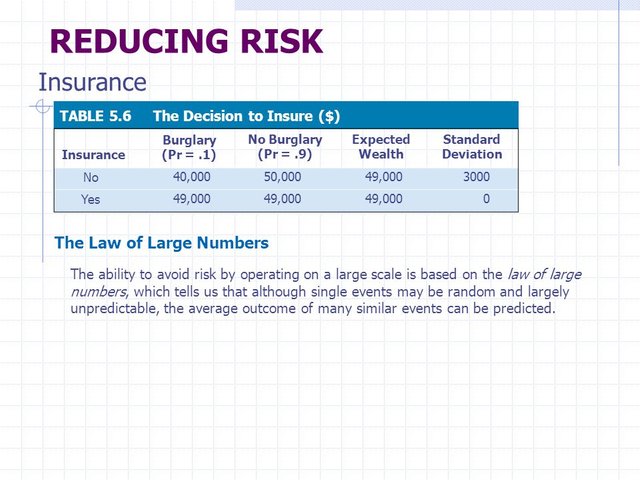

Law of large numbers insurance risk. The law of large numbers states that if the amount of exposure to losses increases, then the predicted loss will be closer to the actual loss. The use of the law of large numbers allows the number of losses to be predicted better. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future.

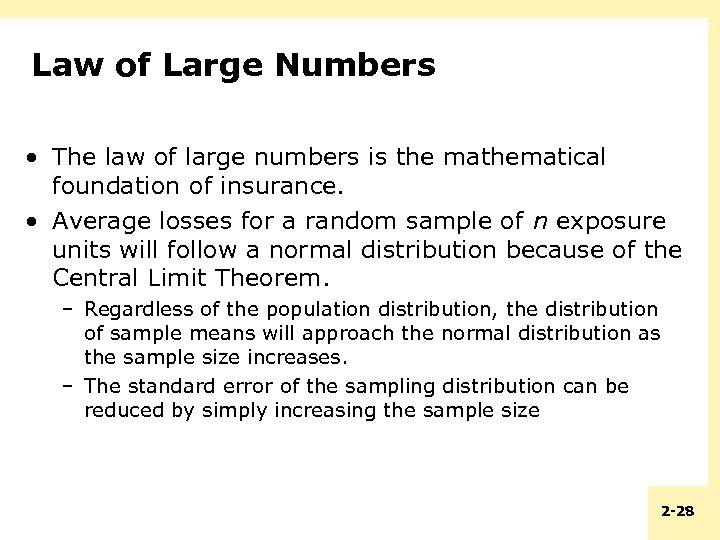

The law of large numbers states that as the number of policyholders increases, the more confident the insurance company is its. In the field of insurance, the law of large numbers is used to predict the risk of loss or claims of some participants so that the premium can be calculated appropriately. Also called the “law of averages”, the principle holds that the average of a large number of independent identically distributed random variables tends to fall close to the expected value.

In the field of insurance, the law of large numbers is used to predict the risk of loss or claims of some participants so that the premium can be calculated appropriately. Insurers (in particular reinsurers) have been gathering data now for decades, and advances in informatics has made this data more easily acceptable and interpretable. The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced.

A risk manager (or insurance executive) uses the law of large numbers to estimate future outcomes for planning purposes. The law of large numbers is less effective with health and fire insurance where policyholders are independent of each other. What is the law of large numbers in insurance?

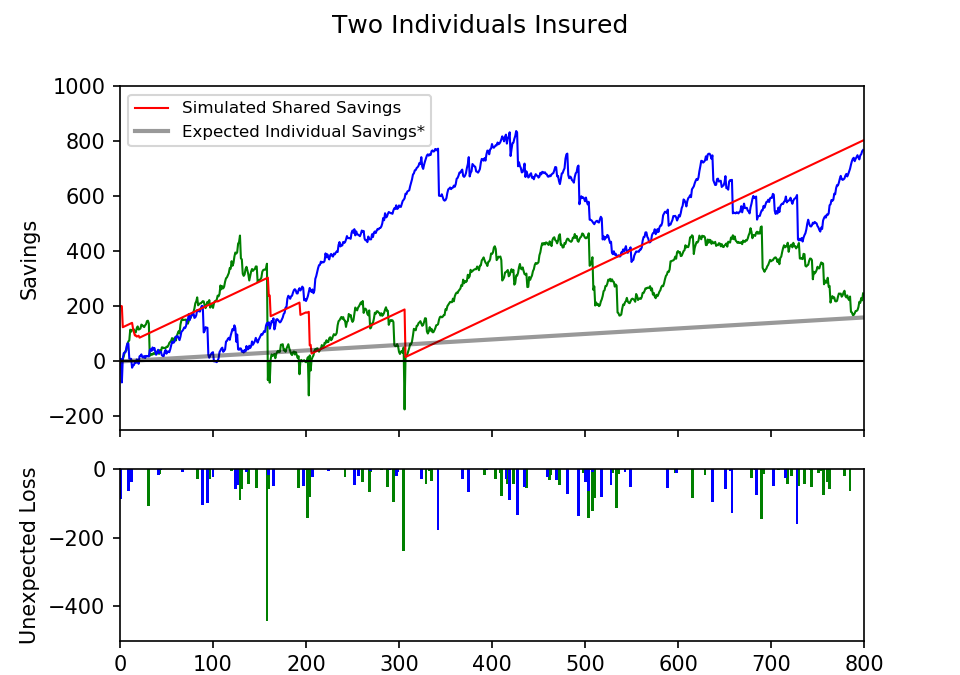

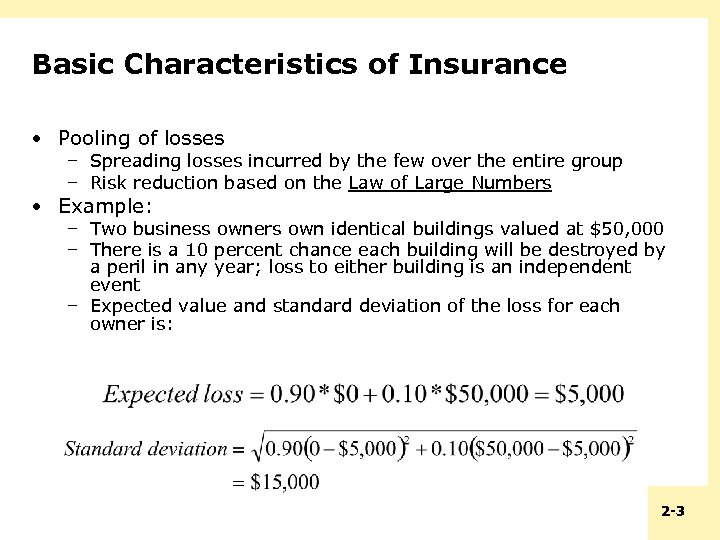

The law of large numbers or the related central limit theorem is used in the literature on risk management and insurance to explain pooling of losses as an insurance mechanism. Financial laws around the world can vary from those found in the u.s. What is the law of large numbers in risk management?

Here apply what is called the law of large number. In other words, the credibility of data increases with the size of the data pool under consideration. This isn't saying that all drivers in that category are high risk, but the low of large numbers says that taken as a whole, it's that category that is most likely to drive unsafely and cause large amounts of health and property damage.

The law of large numbers is a statistical concept that calculates the average number of events or risks in a sample or population to predict something. The size of the pool corresponds to the predictability of the losses, just like the more eggs we deal with, the more likely we are to know how many will be cracked. Pure risk can be categorized as personal, property, or legal risk.

Large numbers in real life. According to this law, the average of the results obtained from a large number of trials will move closer to the. The law of large numbers.

Static risks are more predictable, and, therefore, more. The law of large numbers states that as additional units are added to a sample, the average of the sample converges to the average of the population. This was in the pension industry and was in the early 1970s.

For example there is an average that of every 100 insurance participants, there is one participant who filed an accident claim, then the premium of 100 participants should be able to provide sum assured to. Insurance companies use the law of large numbers to lessen their own risk of loss by pooling a large enough number of people together in an insured group. In the field of insurance, the law of large numbers is used to predict the risk of loss or claims of some participants so that the premium can be calculated appropriately.

Simply stated, the law of large numbers in probability and statistics states that as a sample size grows, its mean gets closer to the average of the entire population. Law of large numbers in insurance. Law of large numbers — a statistical axiom that states that the larger the number of exposure units independently exposed to loss, the greater the probability that actual loss experience will equal expected loss experience.

The law of large numbers states that if the amount of exposure to losses increases, then the predicted loss will be closer to the actual loss. At the time there were rules about how much pension you could take and how much cash when you retired. Insurance company is able to bear the same risk in large numbers.

The pooling of many exposures gives the insurer a better prediction of future losses. Pure risk is insurable, because the law of large numbers can be applied to estimate future losses, which allows insurance companies to calculate what premium to be charged based on expected losses. If historical data is collected for several years for life insurance for example and the information like how many people died during the policy, how many claims were made etc is available then it can be deduced that on.

In insurance, with a large number of policyholders, the actual loss. At the beginning of my working life i worked as a trainee actuary. Even if someone wanted a full pension it was stil.

With a large number of insurers offering different types of coverage. When a firm increases the size of This paper provides a simple example of how the pooling of.

The law of large (small ?) numbers and the demand for insurance 439 adding new risks as by subdividing risks among more people that insurance companies reduce the risk of each. the purpose of the present article is to examine the relevance of this statement in a risk management framework2. The law of large numbers (or the related central limit theorem) is used in the literature on risk management and insurance to explain pooling of losses as an insurance mechanism. For people who buy car insurance, there is the high risk drivers who are male and between 18 and 25 years old.

Risk Management And Insurance Topic 2 Insurable Loss

Chapter 2 The Insurance Mechanism - Ppt Download

Law Of Large Numbers - Wikipedia

The Law Of Large Numbers And The Strength Of Insurance Springerlink

Law Of Large Numbers - Insurance

Ppt - General Principles Of Risk Insurance Powerpoint Presentation - Id6508925

Law Of Large Numbers In Insurance - Youtube

Risk Management And Insurance - Ppt Download

The Insurance Mechanism - Ppt Video Online Download

Solved The Business Of Selling Insurance Is Based On Cheggcom

Law Of Large Numbers Explained Step By Step Walkthrough In 10 Min - Youtube

Cooperation Insurance And The Law Of Large Numbers Medium

Fundamentals Of The Central Limit Theorem And The Mysterious Law Of Large Numbers Steemit

Chapter 2 The Insurance Mechanism Agenda

Health Insurance The Basics - Prezentatsiya Onlayn

Pdf The Application Law Of Large Numbers That Predicts The Amount Of Actual Loss In Insurance Of Life

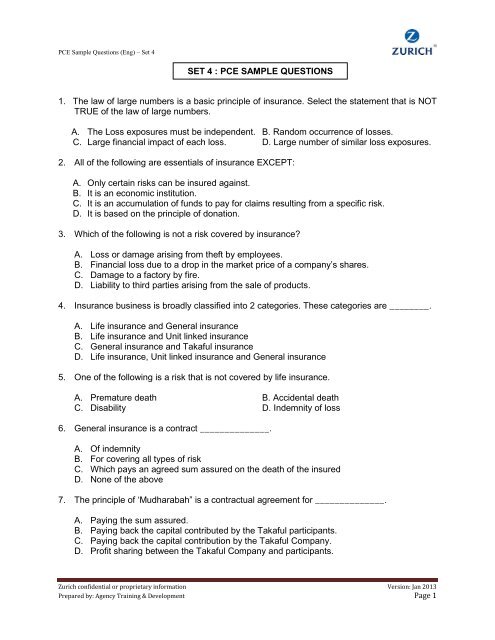

1 The Law Of Large Numbers Is A Basic Principle Of Insurance - Zurich

Chapter 2 The Insurance Mechanism Agenda

Risk Management And Insurance - Ppt Video Online Download

Posting Komentar untuk "Law Of Large Numbers Insurance Risk"