Suing Insurance Company For Bad Faith

If the plaintiffs are successful, the court may award both punitive and compensatory damages. It can cause worry, stress, and can create tensions in a.

Bad Faith Claims Can You Sue Your Insurance Company - Johnstone Carroll Llc

2 black women sue fox news, claiming racial discrimination.

Suing insurance company for bad faith. Courts in canada tend to be conservative with awarding punitive damages, however. When should i file a bad faith insurance claim? It is entirely possible to sue your insurance company when they act in bad faith.

You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. Bad faith insurance attorneys bad faith insurance attorneys serving columbus, fort benning, and nearby areas of georgia suing your own insurance company? Some of the most common indicators that your insurance company is acting in bad faith are poor communication, denying your claim without just cause, pressuring you to accept an unfair settlement, or delaying proper payment on your valid claim.

However, keep in mind that your first step after a claim denial is usually beginning the appeals process. When an insurance company’s actions are in bad faith, people may file separate lawsuits against the companies. Suing your insurance company in small claims court by.

If you’re one of those unfortunate americans who has had a bad experience with their auto insurance company, rest assured that you may have recourse by way of suing for bad faith or breach of contract.while these types of cases are hard to prove in. Under the right circumstances, it is perfectly permissible and appropriate to file a lawsuit against insurance companies, especially if you believe they are engaging in bad faith practices. When insurance bad faith occurs, you can take action and decide that you won’t settle for less.

If your insurance provider denies your claims wrongfully or engages in any of these other tactics, you can file a lawsuit claiming insurance bad faith. If you’re one of those unfortunate americans who has had a bad experience with their auto insurance company, rest assured that you may have recourse by way of suing for bad faith or breach of contract.while these types of cases are hard to prove in. When your insurance company delays, you’re stuck:

426, 429, 344 s.e.2d 906 (1986) (“bad faith may arise when an insurer unjustifiably refuses to settle a claim within the insurer’s coverage limits, thereby exposing its insured to liability in excess of the policy limits.”); You can file a bad faith lawsuit in the following scenarios: In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith.

Bad faith is broadly defined as dishonest or unfair practices. You can sue an insurance firm for other reasons besides bad faith. Although these types of cases are hard to prove, if you have a strong case, you might be able to use the legal system.

To sue an insurance company for bad faith, you file a lawsuit in the appropriate court. This will require the help of an attorney, who will represent you in court. A bad faith lawsuit is a separate lawsuit against an insurance company for not settling cases when they should settle them, and these bad faith lawsuits can often result in verdicts that are much higher than the underlying personal injury lawsuits.

Do you have questions about suing your insurance company for bad faith? If your insurance company has denied your claim in bad faith, or if it is delaying the processing of your claim in bad faith, you may have grounds to file a lawsuit and you should speak with an attorney, promptly. Suing insurance company for bad faith.

Bad faith claims in missouri. Lawsuits against insurance companies are usually either filed strictly based on breach of contract—where the company simply didn’t follow the terms of the policy—and/or bad faith—where there were damages associated with the company’s conduct, especially any mental or emotional damages if the conduct was egregious in any way. The failure to investigate a claim in a timely manner, for example, can leave a policyholder with more than just financial stress:

Recognizing these signs is your first step in determining how to sue an insurance company for bad faith. Your insurer denied or delayed your payout without being able to give you a valid reason. Suing a health insurance company for bad faith could result in the insured recovering actual claim damages as well as punitive damages.

Missouri only has one claim against insurance companies with the language “bad faith” in it. Can i sue the other party’s insurance company for bad faith if they refuse to accept a reasonable settlement offer from me? It is normally reserved for cases in which the insurance.

Suing insurance companies for bad faith is a way to hold insurance companies responsible if they have in any way deceived or abused their policyholders. However, missouri allows for three types of claims an insured can bring against their insurer: When you purchased insurance, you did so with the knowledge that you would be required to pay premiums to your insurance company.

If you are involved in a personal injury lawsuit against. An example of when an insurance company breaches their duty of good faith and fair dealing would be wrongfully denying a properly filed and covered claim. Bad faith refers to dishonest practices, sometimes with fraudulent intent.

Your insurance company didn’t respond to your claim or appeal. Only the policyholder can sue the insurance carrier for bad faith, because the covenant of good faith is based on the contractual relationship between the two. A common type of lawsuit against insurers is bad faith lawsuits.

Failure to defend, bad faith failure to. For example, if the insurer does not agree to defend a claim, and a customer gets a court judgment entered against him or her, the insurer may be responsible to pay the judgment if it. You can’t make repairs until your insurance company investigates, but your insurance company keeps delaying the investigation.

Review these insurance company bad faith tactics and examples to help identify if your insurance company is acting in bad faith. When this duty is violated, the insurance company can be liable in court for their bad faith actions. An insurance company can make a wrong decision, or a bad decision, or have a difference of opinion with an insured.

To sue an insurance company for bad faith, you file a lawsuit in the appropriate court. You may be able to recover the coverage amounts that you are owed, compensation for any additional damage that their delays and failure to pay have caused, and additional statutory damages. Can i sue my insurance company for bad faith advice.

Insurance Bad Faith Insurance Company Bad Faith Nevada

2

Lawyers Who Sue Insurance Companies Suing Insurance Companies

State Farm Bad Faith Insurance Practices Mccormick Murphy Pc

Can You Sue An Insurance Company For Bad Faith Insurance Bad Faith Lawsuits Insurance Bad Faith Anidjar Levine

How To Sue An Insurance Company For Bad Faith - Her Lawyer

Can I Sue The Insurance Company For Bad Faith In Sc Law Office Of Kenneth E Berger

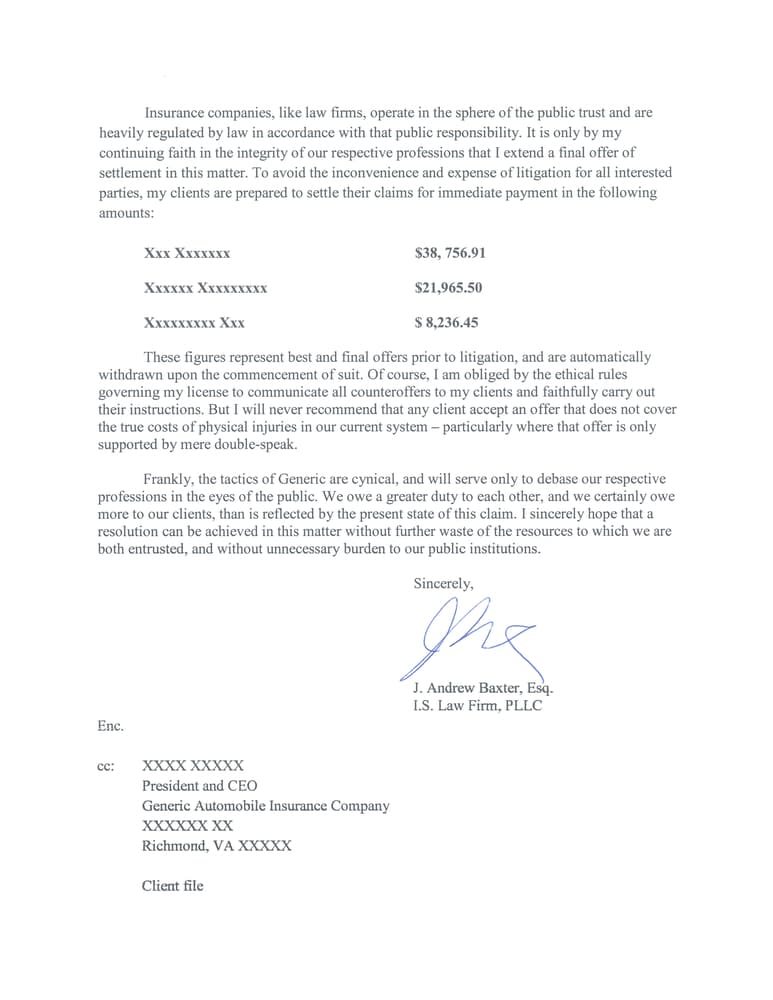

Insurance Bad Faith Negotiations - Is Law Firm Pllc

![]()

An Idiots Guide To Bad Faith Insurance Claims Claimsmate

Insurance Bad Faith Law - Can I Sue My Health Insurance Company

Can You Sue An Insurance Company For Denying Your Claim

When Why How To Find A Bad Faith Insurance Lawyer

How To Sue An Insurance Company For Bad Faith Disability Denial

1 Best Insurance Claim Lawyers Hollywood Fl - Scher And Scher Law Group

How To Sue An Insurance Company For Bad Faith Disability Denial

How To Sue An Insurance Company For Bad Faith Jack Bernstein

Suing Your Insurance Company For Bad Faith - Damore Law Group

Suing An Insurance Company For Denying Claim - Stoy Law Group Pllc

What Is Bad Faith For An Insurance Company -

Posting Komentar untuk "Suing Insurance Company For Bad Faith"