Renters Insurance Philadelphia Cost

State farm delivers options, from start to finish. The good news is, a renters insurance policy from geico can cost as little as $12 per month!

Best Renters Insurance In Philadelphia Customer Rankings Clearsurance

The average cost for renters insurance in pennsylvania is $13 per month.

Renters insurance philadelphia cost. Allstate ® renters insurance is not only reliable, but it's also affordable and can cost you less than you think. The average cost of renters insurance in pa is $14 per month, or $165 per year. Our personal property calculator can help you customize your renters insurance policy with what works for you based on your personal belongings.

Despite these variables, renters insurance is typically very affordable. $10,000 property damage liability per accident. Finding cheap renters insurance in philadelphia starts with shopping around and comparing policies.

$25,000 bodily injury liability per accident. Like a good neighbor, state farm is there®. Pfcu will connect you with unmatched renters insurance for an affordable price, but we don’t stop there.

Request a quote for renters insurance. Other factors that can affect your rate include: If you also insure your car with allstate you may be able to pay as little as $4* a month.

You can also create a virtual inventory list using our personal property scanner in geico mobile. Renters coverage costs less than you might think. This article is designed to help you make an educated decision regarding a renters insurance purchase and discusses why people choose to purchase renters insurance, how much renters insurance costs and details that you need to consider when choosing a policy.

Most renters buying apartment insurance can expect to pay $20 or less per month for renters insurance. In areas in which fire, lightning, wind, or hail are common, renters insurance could be more expensive. Usaa, the cheapest option, has an average rate of $10 per month, while the most expensive, nationwide, costs around $30 monthly.

Depending on the state you live in, the average cost of renters insurance can vary between $12 and $37 per month (or $139 to $442 per year). An allstate renters policy has an average monthly premium of about $16 1. Title insurance protects buyers and lenders against claims on the title of.

But again, this will depend on a variety of factors. The average cost of renters insurance in philadelphia, pennsylvania, is $212 per year or $18 per month. The average cost of renter's insurance is about $15 per month, but how much renters insurance could cost varies by your location and coverage amount.

The average renters insurance cost in the u.s. A policy covering $60,000 in property, with a $1,000 deductible and $300,000 in liability is just $36 a month. The condition, age, and size of your building.

The value of your possessions. You’ll want enough personal property coverage to help you replace your belongings in case of a total loss. If your landlord/complex requires insurance, we can send proof of insurance to your landlord/complex.

You can purchase coverage for about $13 per month, or $153 per year — this is about 7% cheaper than the average cost of renters insurance in pennsylvania. Two of the most common levels of renters insurance coverage are $25,000 and $50,000. That’s solid coverage for less than the cost of a few cups of coffee a week.

Based on the national association of insurance commissioners (naic) survey, renters insurance runs about $15 a month for approximately $35,000 in coverage limits. The best price for renters insurance in pennsylvania we found is just under $14 per month, or $165 per year. $15,000 bodily injury or death per person.

While it's not the cheapest renters insurance in the state, state farm is still affordable: Get an insurance quote in philadelphia to see your rates today. Finding the right renters insurance company for you depends on your personal interests and needs.

Pay as low as $150 a year. The national average renters insurance cost for a policy with recommended coverage levels of $40,000 for personal property, a $1,000 deductible and $100,000 of liability protection is $27 a month. The two factors to consider for renters insurance are personal property and liability coverage.

Many companies will start personal property coverage at. →read more about how much renters insurance costs how renters insurance works Average cost of renters insurance.

Your needs will vary based on the vehicle you want to insure, and your budget. $25,000 bodily injury liability per person. State farm, lemonade, allstate, travelers and stillwater.

Depending on your state, an average policy could cost twice what. $10,000 property damage liability per accident. It costs aboust $10/month for renters insurance, but i save all that money through the discount i then get for having two policies.

The cost varies depending on the provider, but current estimates range from 0.5% to 0.75% of the purchase price for your title insurance premium in philadelphia. The city, state, or neighborhood where you rent. See reviews, photos, directions, phone numbers and more for the best renters insurance in philadelphia.

The average cost of renters insurance varies depending on what kind of coverage and deductible you select, but can cost as little as $20 a month with nationwide. We pulled renters insurance quotes online from five of the most popular insurance companies: What you need to know about renters insurance before moving into your philadelphia apartment.

Get a quote today to learn how much you would pay for renters insurance: The average yearly cost of renters insurance in philadelphia is $212. Renters in the city can save as much as $20 per month by shopping around.

But again, this will depend on a variety of factors. If you want to know how much you would have to shell out approximately, look up the average in your zip code and make sure you get a quote from a reputable insurance agent or company. We insure many types of vehicles, including delivery trucks and snowmobiles.

You Will Never Believe These Bizarre Truth Behind Cheap Auto Insurance Online Cheap Auto Insuran Home Insurance Quotes Auto Insurance Quotes Insurance Quotes

Business Analyst Resume Samples Luxury Capital Market Business Analyst Resume Business Analyst Resume Resume Examples Business Analyst

Daley Insurance Auto Tags Home Rental Insurance

The Best Cheap Philadelphia Car Insurance Companies - Valuepenguin

Best Home Insurance Rates In Philadelphia Pa Quotewizard

The Best Cheap Renters Insurance In Philadelphia In 2021 Moneygeekcom

The Ultimate Guide To Home Insurance Homeowners Insurance Insurance Industry Home Insurance

The Best Cheap Renters Insurance In Pennsylvania - Valuepenguin

1900s The Home Insurance Company New York Reverse Glass Sign In 2021 Umbrella Insurance Home Insurance Quotes Home Insurance

How Much Does Renters Insurance Cost

Best And Worst Cities For Repairing Bad Credit Apartmentguidecom Bad Credit Bad Credit Score Average Credit Score

The Best Renters Insurance In Philadelphia

Rents Are Heating Up Infographic Marketing Infographic Real Estate Infographic

Unique Homes Would You Rather Live In A Former Brothel Or Fire Station - Real Estate 101 - Trulia Unique Homes For Sale Fire Station Real Estate

Key Features Of Health Insurance Policy Insurance Policy Health Insurance Supplemental Health Insurance

Neat Infograhic Insurance Autoinsurance Infographic Car Insurance Rates Compare Car Insurance Car Insurance

The Best Cheap Renters Insurance In Pennsylvania - Valuepenguin

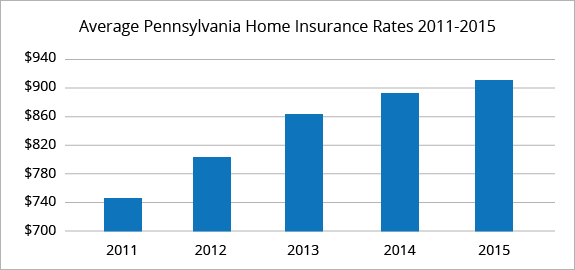

Philadelphia Home Insurance Rates Quotes Agents Reviews Analysis In Pennsylvania

Mutual Of Omaha

Posting Komentar untuk "Renters Insurance Philadelphia Cost"