Pro Rata Insurance Formula

In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance interest in the asset; There many ways to calculate pro rata nearly all of which have some subtle variation dependent on the application.

Analysis Of Insurance Contracts - Ppt Video Online Download

Pro rata insurance is a kind of policy that upholds a standard of payout that the industry deems proportionate.

Pro rata insurance formula. Assume annual premium at $20,000 3. A lump sum may come from: The calculations below will show unearned (return premium) factors.

Per share dividend = total dividends / total number of outstanding shares you can then multiply the per share dividend amount by the total number of shares each shareholder possesses. How to calculate pro rata. Pro rata bills are generally calculated by dividing the total billing amount by the minimum billing unit (e.g., unit of electricity, number of days, gigabytes of data) and then multiplying the result by the number of billing units actually used to arrive at the amount to be charged.

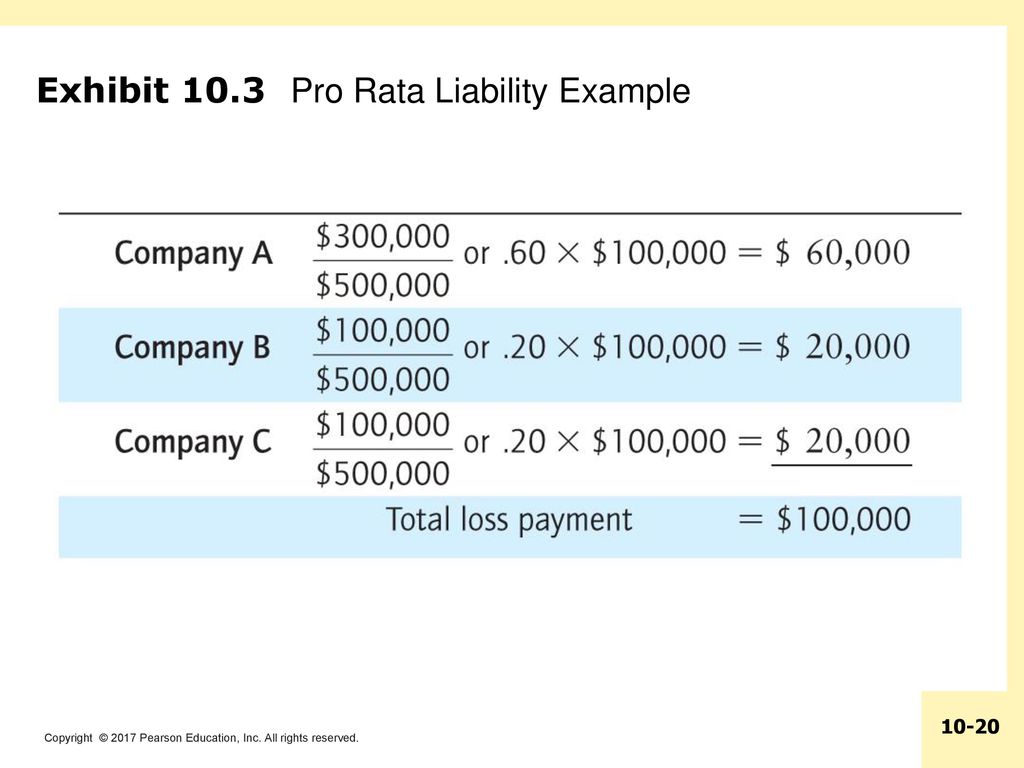

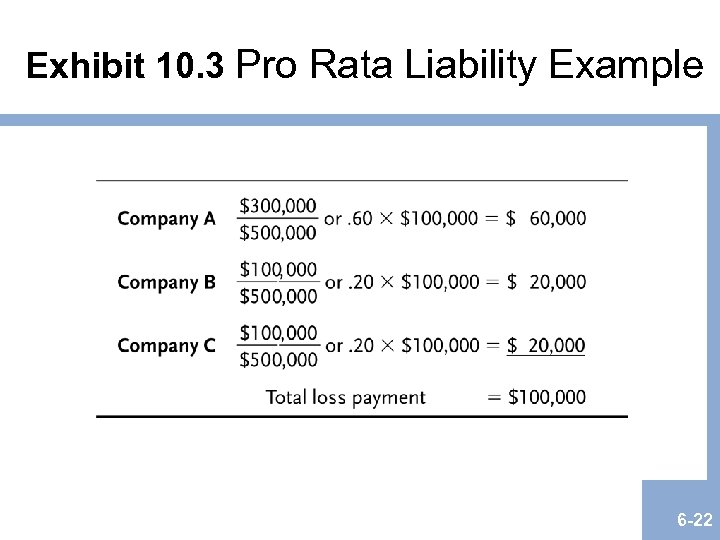

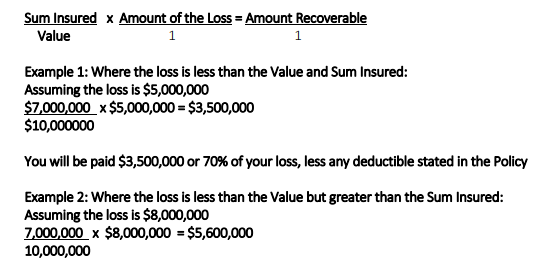

Pro rata liability formula a formula used to determine the amount of coverage each insurer pays when more than one source of insurance is available to handle a given loss. What i need a formula to work out is if $10,000 funding is started on 15 january 2016 what pro rata amount will be spent in the 2015. If there is full recovery of $500.00:

This is also known as the first condition of average. Buldings (10,000,000) + contents (2,000,000) = total insured (12,000,000) 2. You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills.

=b4/yearfrac(b3, b2, 1) assuming there's no mandated convention for the number of days in a year. This is applicable to many insurance transactions, such as insurance payout or cancellation. Then, multiply that number by each individual bill amount to get each pro rata amount.

Hi all, i am racking my brain trying to work out a suitable formula to work out a flow on effect. The pro rata premium due for this period is ($1,000/365) x 270 = $739.73. To determine shared liability, divide the first carrier's coverage amount by the total coverage amount from all sources.

Medium risks commercial building (restaurant) (100% pml). Your formula assumes annual policies. Take the coverage written by company a, divide that amount by the total coverage written by all sources and multiply the resulting percentage by the actual loss amount.

Pro rata cancellation — the cancellation of an insurance policy or bond with the return of unearned premium credit being the full proportion of premium for the unexpired term of the policy or bond, without penalty for interim cancellation. Shareholders receive dividends in direct proportion to the number of current stocks. A simple formula to calculate pro rata dividends is:

750,000 / 250,000 = $3 per share. Assume a loss of $500.00 subject to a $100.00 deductible with $50.00 in allocated loss adjustment expenses: The default will display short rate factor for a one year policy which is 90% of pro rata factor.

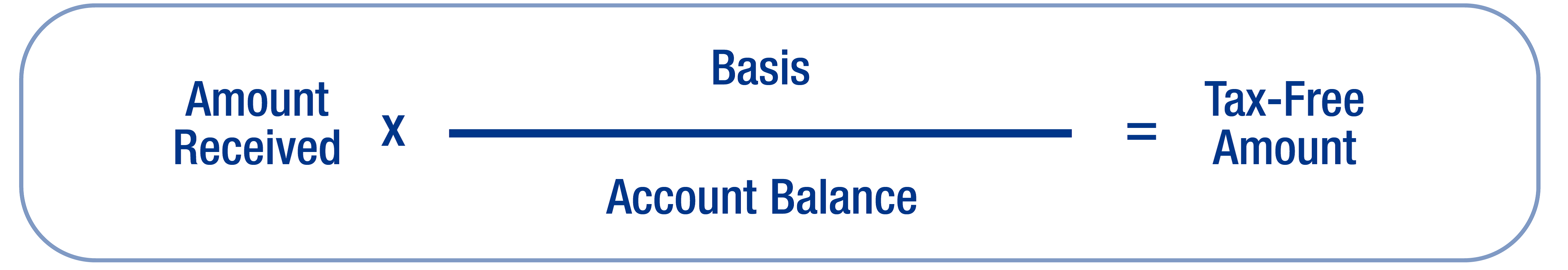

You can use this formula if you would like to verify the calculations. If larry tried to do a $10,000 roth ira conversion, the same formula applies, and his tax return will now include $9,000 in taxable (converted) funds. Although vertafore has made every effort to insure the accuracy of the calculator, vertafore does not guarantee the accuracy of the calculator or the suitability for a specific purpose.

Please keep in mind that commonwealth insurance partners, llc has provided calculator as a service to its clients, with no warranties or promise of proper function. Then, multiply that number by each individual bill amount to get each pro rata amount. Per share dividend = total dividend amount / total number of outstanding shares using the information provided above, we get the per share dividend amount:

Situation is we supply funding to individuals for 12 month periods with varing start dates, our centralised funding is run on the financial year 1st july to 30 june. It can also be used to work out equitable payments when more than one insurer provides coverage. Pro rata claim settlement formula.

Instead, calculating pro rata amounts proportionally allocates the amounts between the different. Casepeer calculates the pro rata amount for you. The key things to identify when designing a formula are the amount you need to apportion (a) and the fraction of this you need to calculate (an enumerator (e) and denominator (d)).

The formula for computing pro rata coverage is a tool insurance companies use to determine equitable coverage rates. The general annualized premium can be obtained with: You can also multiply the total settlement amount by 0.3333333 or 33% then divide it by the total amount of the medical bills.

Casepeer calculates the pro rata amount for you. Pro rata / short rate calculator. Pro rata calculation examples 1.

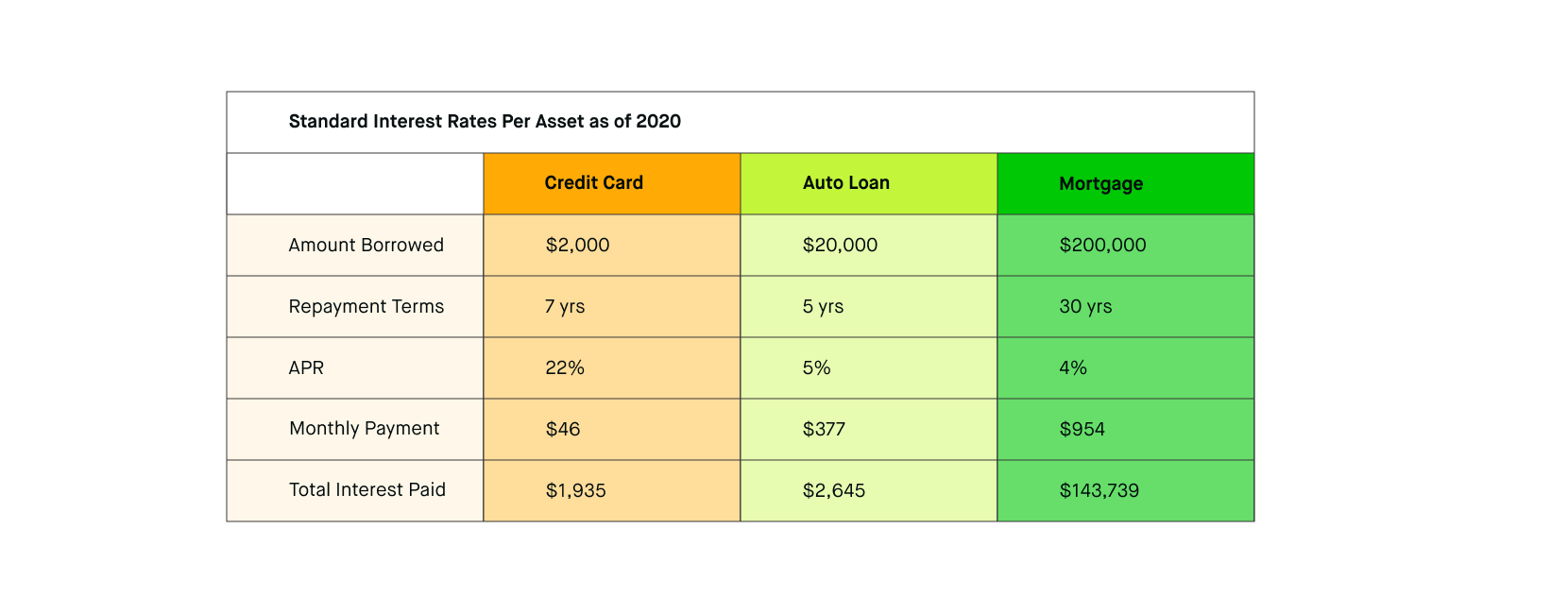

Pro rata for interest rates pro rata calculations are also used to determine.

Pro Rata Insurance Formula - Youtube

Insurance Wheel

/GettyImages-1151374411-6c4db7a60f1e4c0b823ecda146aeb8a8.jpg)

Pro Rata Definition Proportionate Allocation

Analysis Of Insurance Contracts - Ppt Download

Crc015 Pro Rata - Concordia Realty Corporation

Pro-rata Formula - Retirement Learning Center

Rent Understanding Proportionate Share - Realogic

Ch 10 Analysis Of Insurance Contracts Ch 6

Chapter 6 Analysis Of Insurance Contracts Agenda Basic

Xrm Formula 052 - Calculate Pro-rata Amounts North52 Support

Chapter 6 Analysis Of Insurance Contracts A Genda Basic Parts Of An Insurance Contract Deductibles Other-insurance Provisions - Ppt Download

Lecture No 19 Analysis Of Insurance Contracts Agenda

Download Insurance Pro-rata Calculator App World Apps - Bm8dgos6lb8m Mobile9

What Is Pro Rata - 2019 - Robinhood

What Is Pro Rata - 2019 - Robinhood

Average Clause - Jn General Insurance Jngi

Condition Of Average - Wikipedia

Per Stirpes Vs Pro-rata Whats The Difference Regnum Legacy

Use Excels Yearfrac Function For Pro-rata Calculations - Youtube

Posting Komentar untuk "Pro Rata Insurance Formula"