What Is Rebating In An Insurance Contract

Rebating is defined as directly or indirectly offering or giving as an inducement to purchase insurance anything of value whatsoever that is not plainly specified in the life insurance policy. Agents can rebate commissions on any type of insurance, including auto and homeowners coverage.

Insurance Rebating Everything You Need To Know Insurance Pro Blog

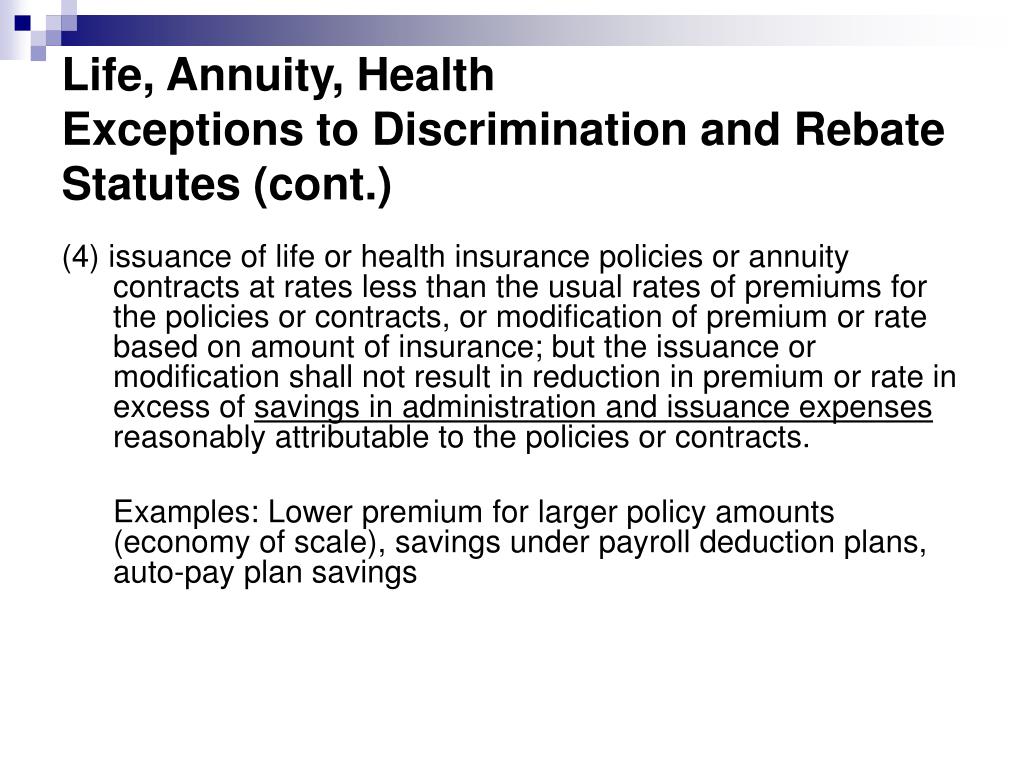

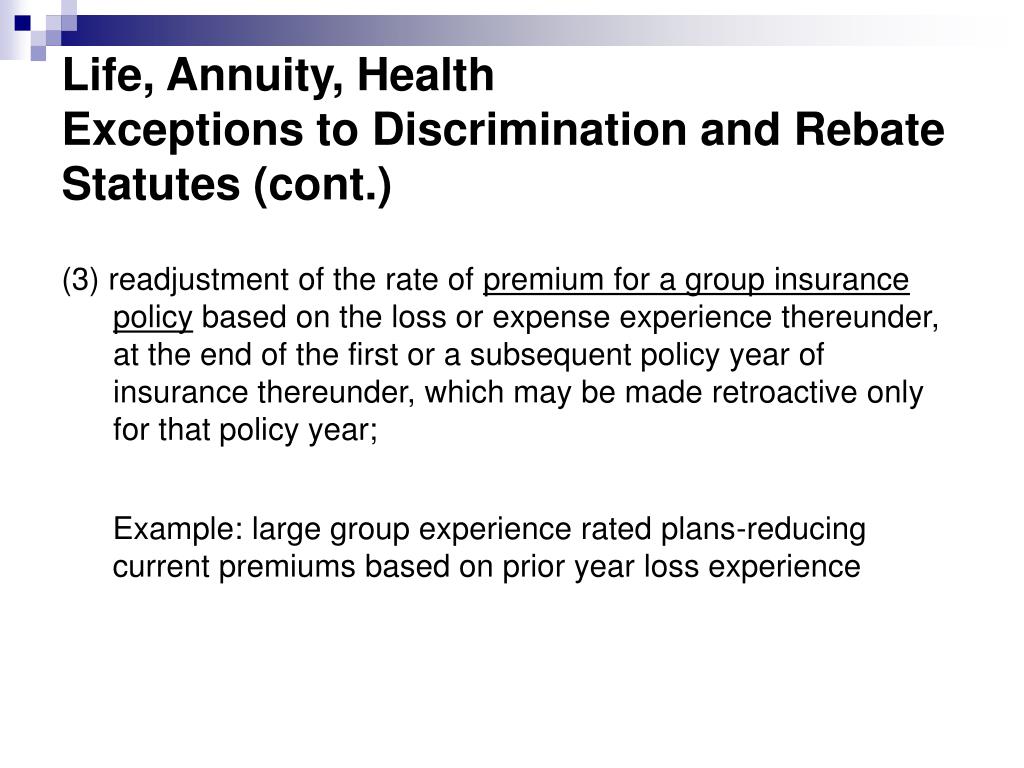

Knowingly permitting or offering to make or making any contract of life insurance, life annuity, accident and health insurance or other insurance, or agreement as to such contract other than as plainly expressed in the insurance contract issued thereon, or.

What is rebating in an insurance contract. • any agreement to pay any part of a policy's premium Rebating violates the terms of the insurance policy and is illegal. A refund of premiums resulting from favorable policy persistency.

It is, however, a practice that can lead to ethical lapses. Any agent or agency premium payment on behalf of a prospect. What is an example of rebating in insurance?

The rebate is typically funded by the insurance agent. Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value. The contract other than as plainly expressed in the contract, or pay, allow, give or offer to pay, allow, or give, directly or indirectly, as inducement to the insurance, or annuity, a rebate

As a rule, all insurance contracts except personal insurance are contracts of indemnity. What is an example of rebating? Paying or allowing, or giving or offering to pay, allow, or give (directly or

Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value. Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value. A twist happens when you pay more money than what was agreed upon, while rebated is when you pay less.

According to this principle, the insurer undertakes to put the insured, in the event of loss, in the same position that he occupied immediately before the happening of the event insured against, in a certain form of insurance, the principle of indemnity is modified to apply. Broker fee agreements are negotiated at arm’s length between the broker and client. An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale.

Most states define insurance rebating as an offer or inducement an agent/broker uses to get a prospective customer to buy an insurance policy where the inducement falls outside of the features of the life insurance contract. Any offer of free insurance that is contingent on buying insurance. Rebating is the practice of returning the broker's commission, or a portion of it, to the insured with the desire of inducing an insurance sale.

Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Twisting and rebating in insurance is the act of paying a commission to an agent or broker for their business. An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale.

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical.

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. And an agent who breaks the restrictions can have his contract terminated. Top 10 what is rebating in insurance answers.

In the insurance business, rebating is a practice whereby something of value is given to sell the policy that is not provided for in the policy itself. Rebating, defined generally as giving a policyholder material consideration in return for buying insurance, has been illegal to extremely. An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale.

But while not illegal, most of the insurance agents have restrictions with the insurance companies. Typically, the rebate is received in the form of a check which you can either invest in the policy of insurance yourself or use. Rebating is a tactic used by insurance companies to lure consumers into buying their products.

Rebating includes, among other things: Jul 6, 2020 — rebating is a way of making a potential insurance client buy the insurance product by returning the commission meant for the broker or agent as. Unlawful rebating is solely in the eyes of the state insurance regulator.

It is an insurance policy that requires the consumer to pay a certain amount of money before they can be covered for any future expenses. This practice has been around since the 1800s and continues today with many industries, especially as we continue to see mergers in the. Rebates can be made in the form of cash, gifts, services, payment of premiums, employment, or almost any other thing of value.

However, the rebating laws allow giving something of value where it is specified in the insurance contract. Rebating can also be referred to as “inducement.”.

American General Faces 2 Million Jury Trial In Financial Elder Abuse Action - Reif Law Group Pc

2

Understanding Rebating Rules For Insurance Advisors Edge

2

2

Ppt - Rebates Nondiscrimination And Compensation Powerpoint Presentation - Id6017269

Ppt - Rebates Nondiscrimination And Compensation Powerpoint Presentation - Id6017269

Life Insurance What To Look For By Rajesh Minocha - Issuu

Insurance Module V 1 2

/irmi-insurance-checklists-(400x533).tmb-.png?sfvrsn=8)

Rebating Insurance Glossary Definition Irmicom

All About Income Tax Rules Applicable For Life Insurance Policies - Our Lic

Anti-rebating Compensation Disclosure Best Practices For Multi-jurisdictional Regulatory Compliance - Pdf Free Download

2

Rebating In Insurance Means - Insurance

Pdf A Comparison Of Buyback Rebate And Flexible Contracts In A Seller-buyer Supply Chain

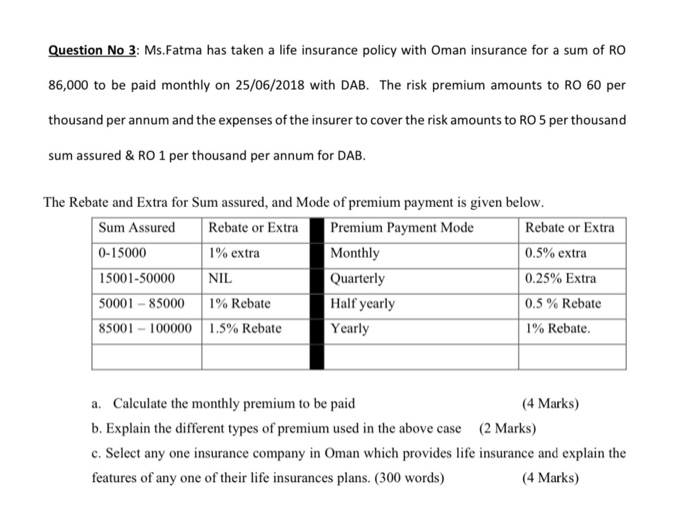

Question No 3 Msfatma Has Taken A Life Insurance Cheggcom

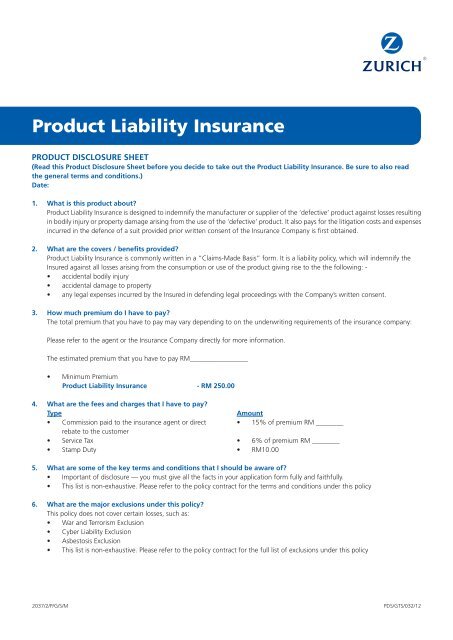

Product Liability Insurance - Zurich

The Private Health Insurance Rebate Explained Iselect

What Is Rebating In Insurance Definition Risks Pros And Cons

Posting Komentar untuk "What Is Rebating In An Insurance Contract"